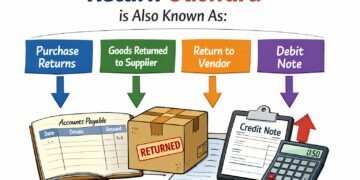

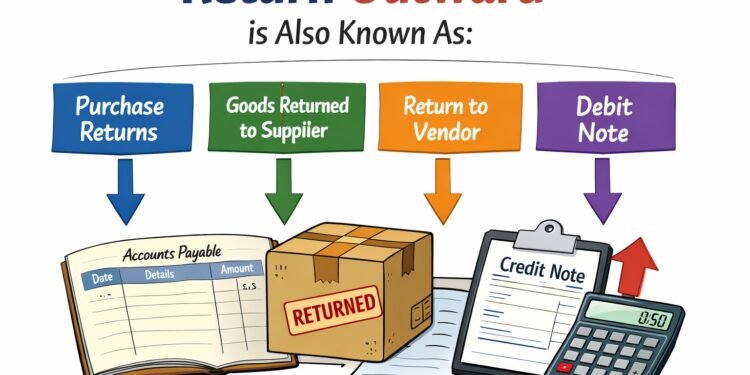

Return Outward Is Also Known As: A Complete Guide

Accounting can sometimes feel like a maze of complex terms and procedures. One term that frequently confuses students, business owners, and budding accountants is Return Outward Is Also Known as something very practical in the world of finance. Simply put, Return Outward refers to goods returned to a supplier, usually due to defects, incorrect delivery, or surplus stock. In accounting, this process is formally recorded as a Credit Note, which acts as proof that the supplier acknowledges the return and reduces the buyer’s liability.

Understanding Return Outward Is Also Known in this context is vital for anyone looking to maintain precise financial records, manage cash flow effectively, and streamline business operations. In this article, we’ll provide a detailed, step-by-step guide to mastering the concept, complete with practical examples, journal entries, advantages, and best practices.

What Does Return Outward Mean?

Return Outward is a business transaction where a company sends purchased goods back to the supplier. The reasons may vary: damaged items, incorrect deliveries, or excess stock. The key point is that the transaction leads to a reduction in the amount payable to the supplier.

Key Characteristics

- Initiated due to defective, damaged, or excess goods.

- Impacts both inventory and accounts payable.

- Recorded formally as a Credit Note.

- Ensures accurate financial statements and audit trails.

For businesses, proper management of Return Outward is essential, as it directly affects both the purchase account and the company’s liabilities.

Why Return Outward Is Also Known As a Credit Note

The term Return Outward Is Also Known as a Credit Note because it represents a formal acknowledgment by the supplier that the returned goods have been accepted, and the payable amount has been reduced.

Practical Example

Imagine a company orders office supplies worth $1,000. Upon inspection, $200 worth of items are found defective. The company returns these goods, and the supplier issues a Credit Note for $200. Consequently, the company’s accounts payable reduces from $1,000 to $800.

This illustrates why Return Outward Is Also Known in accounting terminology—the act of returning goods (Return Outward) is intrinsically linked to the documentation (Credit Note).

Accounting Treatment of Return Outward

Recording Return Outward Is Also Known as a Credit Note ensures that financial statements reflect the correct payable amounts and purchase accounts.

Standard Journal Entry

When goods are returned to a supplier, the typical entry is:

| Date | Particulars | Debit | Credit |

|---|---|---|---|

| xx/xx/20xx | Accounts Payable A/C | 200 | |

| To Purchase Return A/C | 200 |

Explanation: The debit reduces the liability to the supplier, while the credit reflects a reduction in purchases. This keeps both the accounts payable and inventory records accurate.

Importance of Return Outward in Business

Proper handling of Return Outward Is Also Known is crucial for several reasons:

- Financial Accuracy: Ensures the company pays only for goods received in acceptable condition.

- Inventory Management: Reflects the actual stock levels after returns.

- Supplier Accountability: Encourages quality control and proper delivery.

- Audit Trail: Documents all returned goods for auditing purposes.

- Cash Flow Efficiency: Helps manage outgoing payments to suppliers effectively.

By documenting Return Outward accurately, companies maintain trust and transparency with suppliers while keeping their books balanced.

Differences Between Return Outward and Return Inward

Understanding the distinction between Return Outward and Return Inward is essential for accurate bookkeeping.

| Feature | Return Outward | Return Inward |

|---|---|---|

| Definition | Goods sent back to suppliers | Goods returned by customers |

| Accounting Record | Credit Note issued by supplier | Debit Note issued to customer |

| Effect on Accounts | Reduces accounts payable | Reduces accounts receivable |

| Purpose | Corrects defective or incorrect goods received | Corrects defective or returned goods sold |

Misunderstanding this difference can lead to errors in financial reporting, which is why clarity is important.

Common Scenarios for Return Outward

Businesses encounter Return Outward Is Also Known situations regularly. Common scenarios include:

- Defective Products: Items received damaged or unusable.

- Incorrect Orders: Wrong quantity or product type delivered.

- Excess Stock: Surplus goods that the company cannot store.

- Quality Issues: Goods failing quality inspections.

Each scenario requires proper documentation via a Credit Note to ensure financial accuracy.

Advantages of Issuing a Credit Note

A Credit Note generated from Return Outward transactions offers multiple benefits:

- Clear Accounts: Accurately reflects liabilities to suppliers.

- Audit Compliance: Provides evidence for returned items.

- Dispute Resolution: Offers proof in case of supplier disagreements.

- Efficient Accounting: Simplifies adjustments in ledgers.

- Cash Flow Management: Reduces unnecessary payments.

These advantages make it clear why Return Outward Is Also Known as a Credit Note in accounting.

Best Practices for Managing Return Outward

Efficient management ensures smooth operations and accurate bookkeeping.

Tips:

- Inspect goods immediately upon delivery.

- Maintain a return register for all items sent back.

- Always request a Credit Note from the supplier.

- Update accounts payable promptly.

- Communicate clearly with suppliers to prevent disputes.

Following these steps ensures the Return Outward process is seamless and error-free.

Real-World Example of Return Outward

Consider XYZ Ltd., which purchases office equipment for $1,200. After inspection, $300 worth of items are defective. The company returns the items and receives a Credit Note.

- Accounts Payable before return: $1,200

- Credit Note issued: $300

- Accounts Payable after return: $900

This practical example demonstrates the accounting treatment and the link between Return Outward Is Also Known as a Credit Note.

How Return Outward Impacts Financial Statements

Proper recording of Return Outward Is Also Known affects key financial statements:

- Balance Sheet: Reduces liabilities (accounts payable).

- Income Statement: Adjusts purchase costs, indirectly affecting gross profit.

- Cash Flow Statement: Influences outgoing payments when returns are recorded.

Accurate bookkeeping ensures financial transparency and reliability.

Common Mistakes to Avoid

Even seasoned accountants can make mistakes with Return Outward:

- Not requesting or issuing a Credit Note.

- Failing to update the accounts payable ledger.

- Ignoring returns in inventory records.

- Recording duplicate or incorrect amounts.

- Confusing Return Outward with purchases.

Being aware of these errors helps maintain accurate financial records.

Key Takeaways

- Return Outward is the process of returning goods to a supplier.

- It is formally recorded as a Credit Note.

- Proper documentation ensures transparency and accountability.

- Differentiating from Return Inward avoids mistakes.

- Efficient management supports cash flow and supplier relations.

Conclusion: Mastering Return Outward

Understanding Return Outward Is Also Known as a Credit Note is essential for accurate accounting and effective business management. It ensures that payments are only made for goods received in proper condition, maintains precise inventory records, and fosters strong relationships with suppliers.

By adopting best practices, recording transactions accurately, and using Credit Notes effectively, businesses can improve operational efficiency, reduce errors, and maintain trust in their financial systems. Whether you are a student, accountant, or entrepreneur, mastering Return Outward is a key step toward professional accounting expertise.